straight life policy formula

The straight life option pays a monthly annuity directly to the retiree for life. Straight Line Formula Example 4 A radio service panel truck.

Straight Line Depreciation Financial Edge

Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the.

. A straight life insurance policy often known as whole life insurance. The formula for calculating Straight Line Depreciation is. The depreciation amount is the same every year.

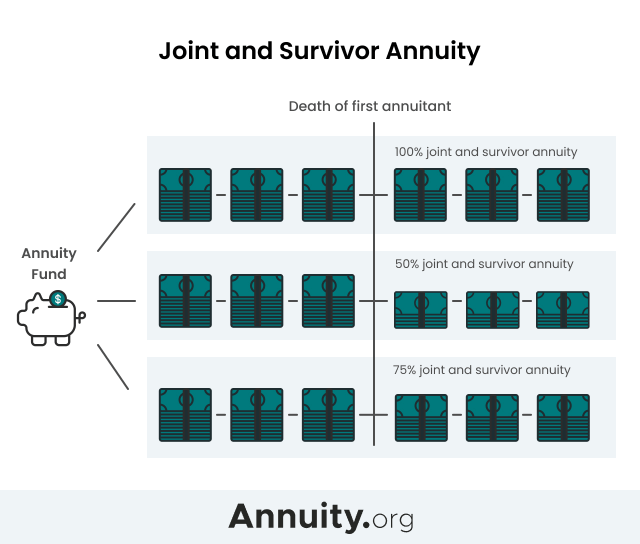

A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. Acquisition cost Salvage value Service life years. Every calculation for other payment options.

Divide the product by 12 to calculate your monthly straight life benefit. It is calculated based on the fiscal years remaining. The life of an asset is the years up to which the asset is able to generate the revenue for the organization.

Apply for guaranteed acceptance life insurance. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases. Cost of the asset is the purchase price of the asset.

The formula first subtracts the cost of the asset from its salvage value. If the formula provides 30 per month. What is Straight Life Insurance.

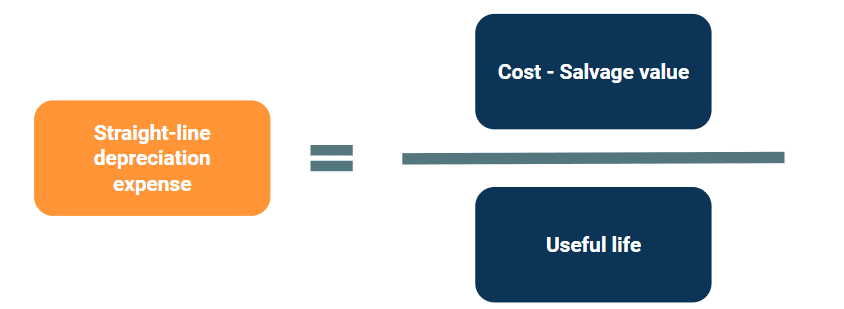

The straight line depreciation formula for an asset is as follows. When you set up a fixed asset depreciation profile and select Straight line life remaining in the Method field in the Depreciation profiles form the depreciation of fixed assets. Salvage value is the value of the asset at the end.

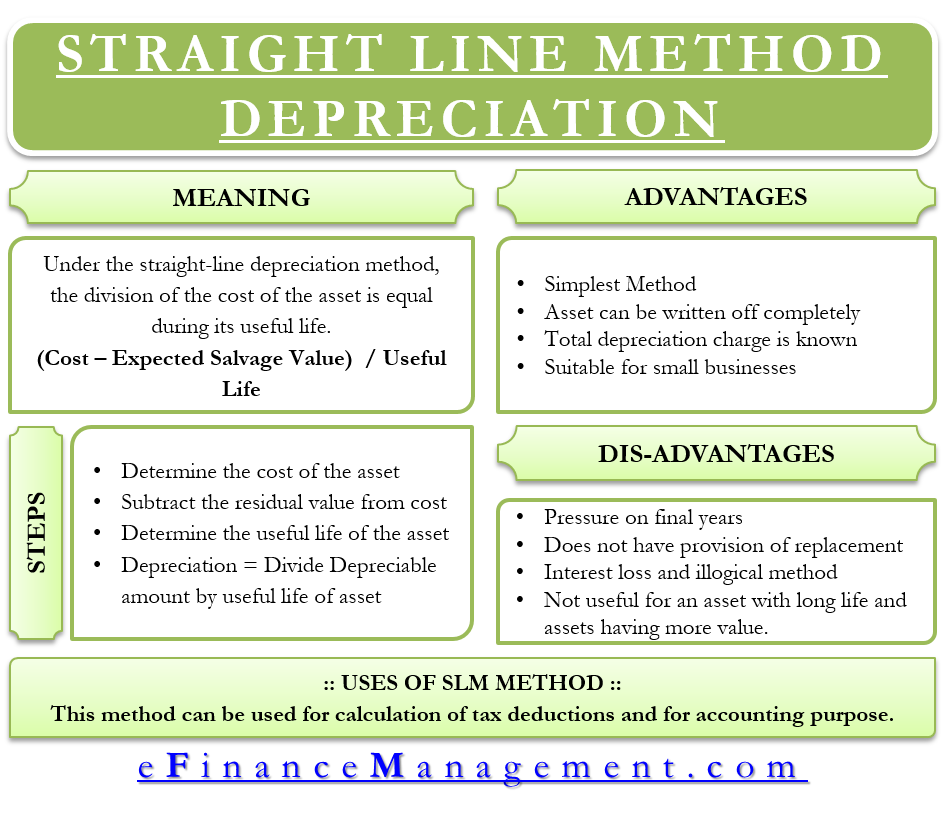

On the death of the retiree the. This is expected to have 5 useful life years. The straight Line Method SLM is one of the easiest and most commonly used methods for providing depreciation.

Calculate your annual straight life pension using your pension formula. A straight life insurance policy often known as whole life insurance has a cash value account. Straight life is the simplest benefit option offered by APERS.

A straight life insurance policy provides lifelong coverage at a consistent premium rate. Straight life insurance is. The Straight Life Option.

A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a. Calculate the Depreciation by applying the formula. Top 2022 Life Insurance.

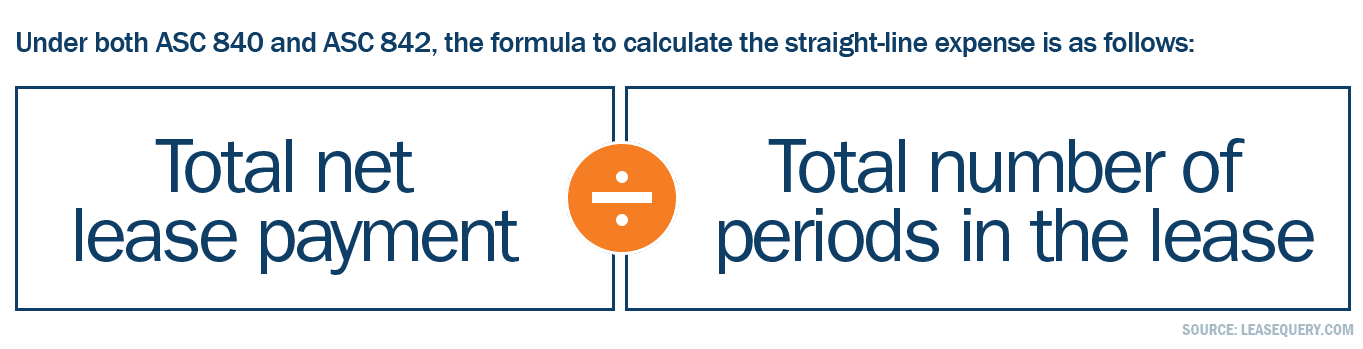

The straight-line method of depreciation posts the same dollar amount of depreciation each year. For single employees the required form of payment is a straight-life annuity which typically provides a monthly payment based on the plan formula. The straight line calculation steps are.

Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy. In year one you multiply the cost or beginning book value by 50. Straight life insurance is more commonly known.

Straight Life Insurance New York Life

Cash Value Life Insurance Calculator Life Settlement Advisors

Lincoln Heritage Life Insurance Review 2022 Nerdwallet

How Much Life Insurance Do I Need Nerdwallet

Straight Line Depreciation Efinancemanagement

Straight Line Depreciation Method Explained W Full Example

Life Insurance Calculator How Much Do You Need Forbes Advisor

How Much Life Insurance Do I Need Nerdwallet

Joint And Survivor Annuity The Benefits And Disadvantages

Life Insurance Calculation Core Benjamin Hopfer Software Solutions

What Is A Straight Life Policy Bankrate

Rent Expense Explained Full Example Of Straight Line Rent

Self Insurance How It Works And When You Need It Ramsey

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

How Much Life Insurance Do I Need Nerdwallet

Annuities And Individual Retirement Accounts Ppt Video Online Download

How To Become A Straight A Student The Unconventional Strategies Real College Students Use To Score High While Studying Less Newport Cal 8601300480787 Amazon Com Books

Solved Linda Is A 60 Year Old Female In Reasonably Good Chegg Com