infrastructure investment and jobs act tax provisions

House of Representatives tonight passed HR. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA.

Infrastructure Investment And Jobs Act Global Law Firm Norton Rose Fulbright

The Infrastructure Investment and Jobs Act.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22748721/1325272963.jpg)

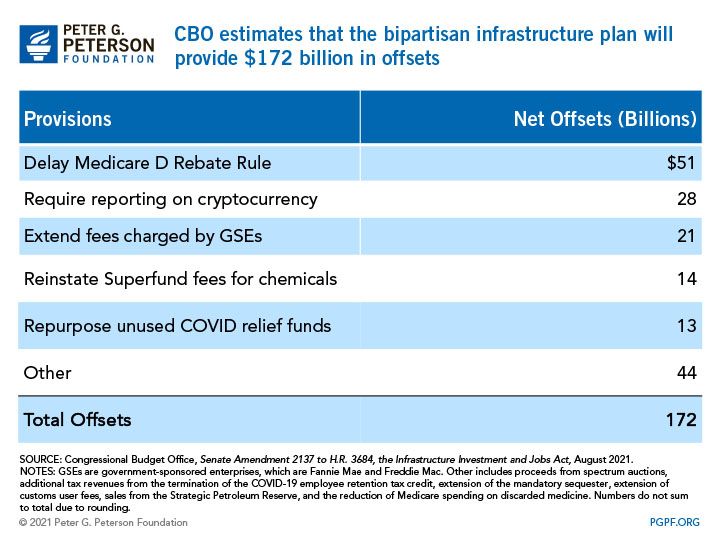

. One way the Democrats got Republican buy-in is that early on they substituted tax increases with compliance measures to fund the bill although the. On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water and broadband improvement there are some tax-related provisions included.

The legislation includes multiple tax-related provisions that may affect you or your business. The Infrastructure Investment and Jobs Act IIJA signed into law on November 15 contains the largest single investment in carbon management provisions since the Department of Energy DOE began funding carbon capture research in 1997. Infrastructure Investment and Jobs Act Tax-Related Provisions.

On November 15 2021 President Joe Biden signed into law HR. The Infrastructure Investment and Jobs Act first passed by the US Senate in August has now been passed by the US House of Representatives on November 5 2021 with an estimated cost of 12 trillion. Tax Highlights from the Infrastructure Investment and Jobs Act.

The vote was 228 to 206. Infrastructure Investment and Jobs Act Contains New Cryptocurrency Reporting Requirements. 3684 the Infrastructure Investment and Jobs Act.

November 11 2021 November 22 2021 Kim Paskal. The Infrastructure Investment and Jobs Act includes tax-related provisions youll want to know about. By Don Carpenter MSAccCPA.

Enrolled agent status is the highest credential the IRS awards. Employee Retention Credit Changes. 4 Precise allocations would change each year because the formulas use current passenger boarding and.

The President has indicated that he hopes to sign. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy water and broadband improvement there are some tax-related provisions included. 15 releasing funds to improve.

President Biden signed the Infrastructure Investment and Jobs Act IIJA into law on November 15 2021. Almost three months after it passed the US. Tax News Views August 10.

He earned the privilege of representing taxpayers before the Internal Revenue Service passing a three-part comprehensive IRS test covering individual and business tax returns. The Infrastructure Investment and Jobs Act signed by the President on Nov. Infrastructure Innovation and Jobs Act.

The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. 5 2021 with an estimated cost of 12 trillion. Almost three months after it passed the US.

Senate passed the same version of the bill on August 10 2021 on a bipartisan basis. Almost three months after it passed the US. The legislation includes tax-related provisions.

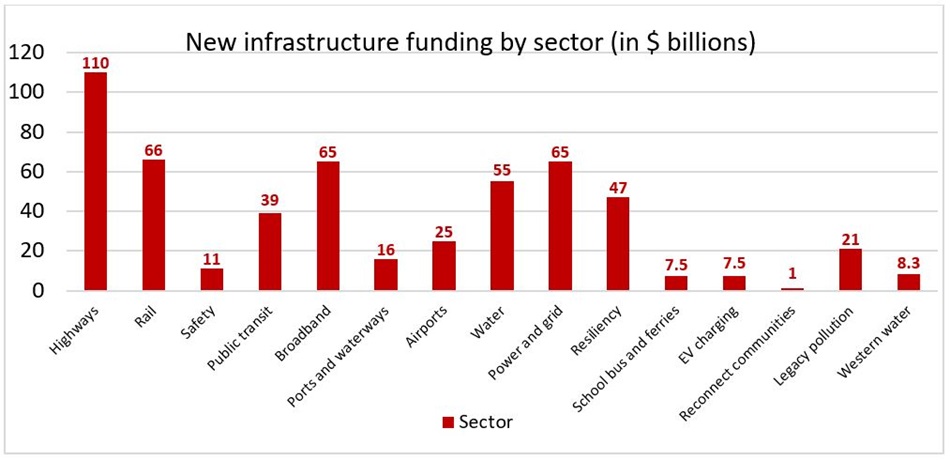

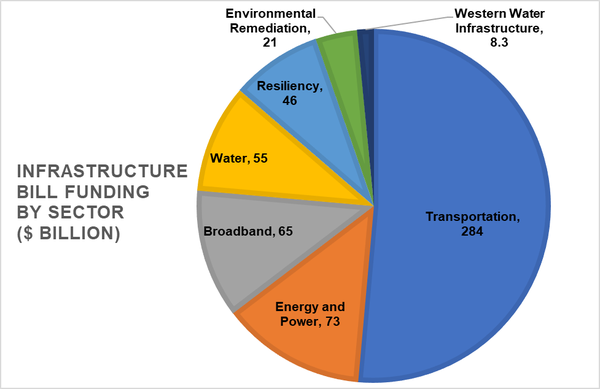

15 2021 presents a number of issues for taxpayers to consider. President Biden signed the Infrastructure Investment and Jobs Act the Act into law on November 15 2021. Among other provisions this bill provides new funding for infrastructure projects including for.

House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. The focus of the legislation was spending of 12 trillion to address infrastructure improvements for the. This title extends several highway-related authorizations and tax provisions including.

While the thrust of the Act embodied in its 2740 pages is 12 trillion of federal expenditures on roads bridges highways internet and other infrastructure-related areas. 3684 popularly called the Infrastructure Investment and Jobs Act Infrastructure Act in a bipartisan ceremony at the White House. While the bulk of the law is directed toward massive investment in infrastructure projects across the country a handful of noteworthy tax.

Importantly IIJA takes a holistic approach to building out the carbon management ecosystem by funding four. RODRIGUEZ -- read once and referred to the Committee on Ways and Means AN ACT permitting authorized state entities to utilize the design-build method for infrastructure projects THE PEOPLE OF THE. Knox is considered one of Americas Tax Experts having taught practitioners all over the country.

Wolters Kluwer Tax Accounting looks at the tax provisions of the Infrastructure Investment and Jobs Act. Infrastructure Investment and Jobs Act. Although the act includes fewer tax provisions than originally introduced.

While the bulk of the law is directed toward massive. Enacts the Infrastructure investment act. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better.

The expenditure authority for the Highway Trust Fund through FY2026 the. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan infrastructure bill. VIEW AS PDF.

S T A T E O F N E W Y O R K _____ 5397 2015-2016 Regular Sessions I N A S S E M B L Y February 20 2015 _____ Introduced by M. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as. Thus congressional action of this bill has been.

The Infrastructure Investment and Jobs Act Includes Tax-Related Provisions Youll Want to Know About by Joe Wilson CPA MST on November 29 2021 in IRS Taxation-Individuals Almost three months after it passed the US. Tax Provisions to Know About. P resident Joe Biden signed the 12 trillion Infrastructure Investment and Jobs Act into law on Nov.

The bipartisan Infrastructure Investment and Jobs Act IIJA which was signed into law on November 15 2021 includes two provisions affecting the reporting of transactions involving digital assets including cryptocurrency for US. The act first passed by the Senate in August was passed by the House on Nov. Roads bridges and major projects.

LinkedIn 0 Facebook 0 Tweet 0 Email 0. The Infrastructure Innovation and Jobs Act which cleared the chamber by a vote of 69-30 would invest roughly 550 billion in new spending over the next five years on so-called hard infrastructure projects and includes limited tax-related incentives and revenue offsets. 3684 by a vote of 228-206 with the support of 13 RepublicansThe Senate passed the bill in August 2021 also with bipartisan support.

Infrastructure Investment and Jobs Act in New York.

House Passes 1 2 Trillion Infrastructure Investment And Jobs Act

What Is In The Bipartisan Infrastructure Legislation Npr

House Passes Infrastructure Bill With Tax Provisions Kpmg United States

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

Senate Preps For Votes On Bipartisan Infrastructure Bill Npr

Infrastructure Bill Includes Some Tax Provisions Accounting Today

Myths And Facts Infrastructure Investment Jobs Act

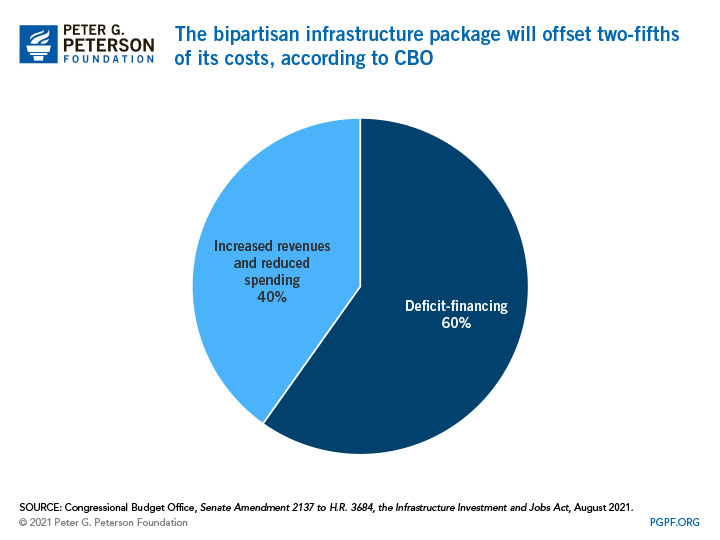

Bipartisan Infrastructure Bill Less Than 40 Percent Paid For

Infrastructure Investment And Jobs Act Global Law Firm Norton Rose Fulbright

New Infrastructure Law To Provide Billions To Energy Technology Projects American Institute Of Physics

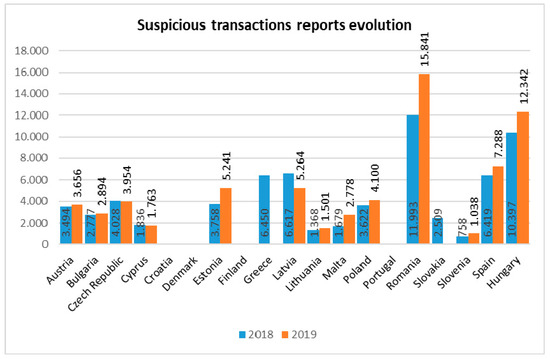

Risks Free Full Text Efficiency Of Money Laundering Countermeasures Case Studies From European Union Member States Html

What Does The Infrastructure Investment And Jobs Act Have For Forestry A Brief Overview Nc State Extension Publications

/cdn.vox-cdn.com/uploads/chorus_asset/file/22748721/1325272963.jpg)

The New Infrastructure Bill Passed The Senate Here S Why It S A Big Deal Vox

Bipartisan Infrastructure Bill Less Than 40 Percent Paid For

Infrastructure Bill Includes Tax Provisions To Know About

Myths And Facts Infrastructure Investment Jobs Act

Infrastructure Investment And Jobs Act Signed Into Law 2021 Articles Resources Cla Cliftonlarsonallen

Build Back Better Bill What S In It For Real Estate In 2021 Real Estate Real Estate Professionals Estates